The post COVID-19 to accelerate supply chain shifts in fragmented trade system: Moody’s appeared first on Adaderana Biz English | Sri Lanka Business News.

COVID-19 to accelerate supply chain shifts in fragmented trade system: Moody’s

New Land Rover Defender – An icon reimagined for the 21st century unveiled by Access Motors

Across seven decades of pioneering innovation, Land Rovers have earned a unique place in the hearts of explorers, humanitarian agencies and adventurers. Proven in the harshest environments on earth, the New Defender maintains this bloodline. Driven by a passion and respect for the original, it delivers transformational breadth of capability. Advanced all-terrain technologies redefine adventure for the 21st century, remaining true to the pioneering spirit that has been a Land Rover hallmark for 71 years.

The New Defender will be available in 90 and 110 body designs, with up to six seats in the 90 and the option of five, six or 5+2 seating in the 110. The model range comprises Defender, First Edition and top of the range Defender X models, as well as standard, S, SE, HSE specification packs. Customers will be able to personalise their vehicle in more ways than any previous Land Rover with four Accessory Packs – Explorer, Adventure, Country and Urban. A choice of advanced petrol and cleaner diesel engines ensure New Defender has the power, control and efficiency for any environment, while a Plug-in Hybrid Electric Vehicle (PHEV) powertrain will join the range next year.

Configurable Terrain Response debuts on New Defender, allowing experienced off-roaders to fine-tune individual vehicle settings to perfectly suit the conditions, while inexperienced drivers can let the system detect the most appropriate vehicle settings for the terrain, using the intelligent Auto function. The new body architecture provides ground clearance of 291mm and world-class off-road geometry, breakover and departure angles. Its maximum wading depth of 900mm is supported by a new Wade programme in the Terrain Response 2 system.

Land Rover has developed a curated exterior palette with unique colours just for New Defender. Comfort is also a key part of New Defender, with interior materials focused on retained newness. Customers can choose from three interior colour schemes with scope for personalisation, available by mixing these with different interior finish options.

Robin Colgan – Jaguar Land Rover Asia Pacific Managing Director, stated, “There is a strong emotional attachment to Defender. It was the only vehicle that could cope with this region’s difficult conditions, which made it a unique proposition. We think of the Defender as part of our legacy, but it is also one owned by communities around the world. People in this region consider this vehicle very much part of their own history. They are custodians of the brand – and it will be the same for the New Defender too.”

Sharing his thoughts, Theo Fernando – Managing Director of Access Motors stated, “This is an extraordinary occasion in the history of both Access Motors and Land Rover. The New Defender is indeed an icon that has been built upon the tough foundations of the original Defender and reimagined to suit the needs of today’s Land Rover enthusiast. With its customary toughness, personalised looks, advanced technologies and unmatched off-road capabilities, the New Defender is sure to fuel the pioneering spirit of thousands of Sri Lankans.”

Access Motors, a member of the Access Group and the Sole Agent for Jaguar Land Rover in Sri Lanka, launched the New Land Rover Defender in Sri Lanka. The first vehicle was officially handed over to its new owner at the launch ceremony held at their state-of-the-art showroom in Colombo 7.

Photo caption: (Above – from left) Access Motors’ Director Ayesh Fernando, Chief Executive Officer Ravi Perera, Managing Director Theo Fernando and General Manager Sales Sanjaya Jayasinghe with the New Land Rover Defender

Access Motors’ Managing Director Theo Fernando and Director Ayesh Fernando unveil the New Land Rover Defender

Access Motors’ Managing Director Theo Fernando and Director Ayesh Fernando unveil the New Land Rover Defender

Guests present at the New Land Rover Defender Sri Lanka launch and (right) the New Land Rover Defender

Guests present at the New Land Rover Defender Sri Lanka launch and (right) the New Land Rover Defender

The post New Land Rover Defender – An icon reimagined for the 21st century unveiled by Access Motors appeared first on Adaderana Biz English | Sri Lanka Business News.

Regional Development Bank accelerates digital impact with Oracle Cloud

The post Regional Development Bank accelerates digital impact with Oracle Cloud appeared first on Adaderana Biz English | Sri Lanka Business News.

HNB partners with Browns Agriculture for offers on agricultural equipment

Sri Lanka’s leading private sector bank HNB PLC, partnered with Brown & Company PLC to offer affordable leasing packages inclusive of attractive benefits for agricultural vehicles in the SME sector. The partnership will offer customers special discounts and facilities for TAFE & Massey Ferguson tractors, Yanmar World & Sumo branded combine harvesters. HNB Head of Personal Financial Services, Kanchana Karunagama and Browns Agriculture, General Manager, Sanjaya Nissanka graced the ceremony held at Browns TAFE Head office to ink the deal. “Sri Lankan farmers have to be equipped with quality vehicles, machinery and equipment to make use of the abundant natural conditions the country is blessed with. We hope that our partnership with Browns will offer our loyal customers in the sector with the most affordable prices, interest rates and services to ensure they have the opportunity to grow their businesses,” HNB Head of Personal Financial Services, Kanchana Karunagama said. The partnership will offer HNB leasing customers a special rate for Massey Ferguson & TAFE Brands of agricultural machinery vehicles. The bank will also offer customers the Prestige Prime credit card providing access to exclusive discounts on automobile products, servicing, spare parts, tyres and batteries. HNB will also waive off the first year annual fee for the card. “Over its illustrious history spanning over 145 years, Browns has become a trusted service provider in the industry, offering high-quality machineries as well as an unmatched aftersales service. Being the undisputed market leader since the inception of the Browns Agriculture Division in 1952, we have always treasured our relationships with customers. We firmly believe that this partnership with HNB will give us an opportunity to better serve our customers by offering affordable leasing solutions and a host of other benefits,” Browns Agriculture, General Manager, Sanjaya Nissanka said. As a strategic solutions provider, Browns has always identified the market demands and expanded its product portfolio accordingly. Therefore, today, the customers have the opportunity to choose from a wide array of products that comes with sophisticated features to generate optimal returns. Browns PLC will offer free registration, Insurance and four doorstep services for all tractor models during the promotional period. In addition to the 12 months or 1000 hours of warranty for Massey Ferguson tractors and 24 months or 2000 hours of warranty for TAFE tractors. Photo caption: (From left) Browns Agriculture- Service Operations Manager, Anton Perera; Browns Agriculture-Business Development Manager, Chanaka Chandrasekara; Browns Agriculture-Deputy General Manager, Niyas Ahamed; Browns Agriculture- General Manager, Sanjaya Nissanka; HNB Head of Personal Financial Services, Kanchana Karunagama; HNB Senior Manager- Leasing, Niluka Amarasinghe; HNB Assistant Manager- Leasing, Roshan De Silva and HNB Business Development Executive (HNB Leasing), Mahesh Ratnayake

The post HNB partners with Browns Agriculture for offers on agricultural equipment appeared first on Adaderana Biz English | Sri Lanka Business News.

20 year old Avishka will receive Rs. 50,000 a month from Nestomalt SALARY for LIFE competition

(From left) Aveen Pathirage, Nestlé Lanka Brand Manager – Nestomalt; Asanka Kumara, Nestlé Lanka Manager – Sales Promotions & Sponsorship; Ruwan Welikala, Nestlé Lanka Vice President – Ambient Dairy; Avishka Koswatta, Winner of ‘Nestomalt – Salary for Life’; Nihal Koswatta, Winner’s Father; and Maleesha Koswatta, Winner’s sister

(From left) Aveen Pathirage, Nestlé Lanka Brand Manager – Nestomalt; Asanka Kumara, Nestlé Lanka Manager – Sales Promotions & Sponsorship; Ruwan Welikala, Nestlé Lanka Vice President – Ambient Dairy; Avishka Koswatta, Winner of ‘Nestomalt – Salary for Life’; Nihal Koswatta, Winner’s Father; and Maleesha Koswatta, Winner’s sister

The post 20 year old Avishka will receive Rs. 50,000 a month from Nestomalt SALARY for LIFE competition appeared first on Adaderana Biz English | Sri Lanka Business News.

Ceylon Dollar Bond Fund gains on recovering Sovereign Bonds

The post Ceylon Dollar Bond Fund gains on recovering Sovereign Bonds appeared first on Adaderana Biz English | Sri Lanka Business News.

Rakuten Viber launches new tools to fight spam on the platform

- Every user’s phone number remains hidden until they share it.

- Online status is hidden.

- Voice and video calls are disabled.

The post Rakuten Viber launches new tools to fight spam on the platform appeared first on Adaderana Biz English | Sri Lanka Business News.

‘Managed Maid’ by English Nursing Care to up-skill your domestic help to provide eldercare

English Nursing Care (ENC), a total solution in home nursing and elderly care, expands its service offerings with the introduction of a brand-new service called ‘Managed Maid.’ The service was developed with the objective of teaching domestic help the specialised skills of looking after the elderly and those that need special care. The ‘Managed Maid’ service would develop the skills of domestic help with expert training and management, to better serve those in need, with the comfort of a familiar face. This innovative service is a unique combination of technical training together with follow up assessments and support in the customers own home. Ensuring that your elderly loved ones are looked after and cared for can be a challenge, English Nursing’s ‘Managed Maid’ service entails an operational training program that involves a team from English Nursing Care coming to your home and carrying out a detailed understanding of the situation in the care space, thereafter they would create a bespoke training programme for your domestic help. The training programme will be delivered and monitored by a qualified nurse taking into account your needs. The bespoke training programme will allow the patient’s needs to be met in their own home – whether for long term care or rehabilitation after a hospital stay. Speaking of this innovative service, Ivanka Fonseka – General Manager, English Nursing Care said, “We are always looking at ways to improve the lives of the elderly and that is why we do understand that sometimes when you get used to someone in your home, it is difficult to adjust to a new person being brought in. This service allows you to provide quality eldercare to a patient at home whilst minimising disruption to their existing routine. Our service of upskilling a domestic helper to provide good quality eldercare provides real support to the family. Our expert staff always remain available when required.” English Nursing Care in Colombo is a supervised home nursing service which allows quality care within the comfort of an individual’s home. Bringing in expertise from the UK, English Nursing aims to develop Sri Lanka’s community nursing and care sector by setting elevated standards in quality and compassionate nursing care in the country. Attesting the efficiency of Managed Maid Eldercare, a family member of one of English Nursing’s existing patients stated, “We needed more specialised care than our home help could provide after my father returned from hospital.. His pressure sores have now cleared due to the supervision of English Nursing Care. The spot checks and a regular report from English Nursing Care keeps me updated on the care that my father is receiving – granting me a great peace of mind.” With over 50 years of experience in community care, English Nursing is developing new ways of delivering eldercare to the customers home. The UK management Team of English Nursing Care works closely with an excellent Sri Lankan team – providing them with management oversight, nursing supervision and training skills to maximize existing patient care. For further information on English Nursing Care, visit their website www.englishnursing.com or call +94 11 4500117.

The post ‘Managed Maid’ by English Nursing Care to up-skill your domestic help to provide eldercare appeared first on Adaderana Biz English | Sri Lanka Business News.

List of institutions brought under the purview of Finance Ministry

Prime Minister Mahinda Rajapaksa has been appointed as the new Finance Minister of Sri Lanka. The new ministerial structure consisting 28 Ministries and 40 State Ministries was announced by President Gotabaya Rajapaksa through an extraordinary gazette notification. Accordingly, two-state ministries were appointed under the Finance Ministry. They are the State Minister for Finance, Capital Market and State Enterprise Reforms, and the State Minister for Samurdhi, Micro Finance, Self Employment & Business Development and Under-utilized State Resource Development. Formulating national economic and financial policies and strategies of the country, Formulating fiscal policy, and macro-fiscal policy management, Preparing national development plan and management of financial resources, Managing national tax policy and effective use of government revenue, Formulating monetary policies, Coordinating public, and private sector activities and conducting economic development activities, are some of the core objectives of the Finance Ministry. Following are the full list of departments and institutions assigned under the Finance Ministry: – Treasury Affairs General Treasury

- Department of National Planning

- Department of Fiscal Policy

- Department of National Budget

- Department of Management Services

- Department of External Resources

- Department of Public Finance

- Department of Treasury Operations

- Department of State Accounts

- Department of Trade and Investment Policy

- Department of Information Technology Management

- Department of Legal Affairs

- Department of Management Audit

- Department of Development Finance

- Comptroller General’s Office

- Department of Inland Revenue

- Sri Lanka Custom

- Department of Excise

- National Lotteries Board

- Development Lotteries Board

- Department of Valuation

- Department of Imports and Exports

- Central Bank of Sri Lanka

- All State Banks, Finance, Insurance and their subsidiaries and affiliates

- Insurance Board of Sri Lanka

- Sri Lanka Insurance Corporation and its subsidiaries and affiliates

- Credit Information Bureau

- Department of Registrar of Companies

- Securities and Exchange Commission of Sri Lanka

- Sri Lanka Accounting and Auditing Standards Monitoring Board

- Public Utilities Commission of Sri Lanka

- Sri Lanka Export Credit Insurance Corporation

- Department of Census and Statistics

- Institute of Policy Studies

- Sustainable Development Council

- Welfare Benefits Board

- Lady Lochore Fund

- Strike, Riot, Civil Commotion and Terrorism Fund

- National Insurance Trust Fund

- Employees’ Trust Fund

- Let’s Protect Children (Daruwan Surakimu) Trust

- Shrama Vasana Fund

- National Health Development Fund

- National Kidney Foundation of Sri Lanka

- Tea Shakthi Fund

- Kapruka Fund

- Public Service Pensioners’ Trust Fund

- Buddha Sasana Fund

- Buddhist Revival Fund

- Skills Development Fund Ltd

- Local Loans and Development Fund

- Thurusaviya Fund

- Central Cultural Fund

- Department of Telecommunications

- Wildlife Trust

- Sri Lanka Media Training Institute

- Department of Internal Trade

- Department of Public Enterprises

- Department of Project Management and Monitoring

- National Operations Centre

- Housing Development Finance Corporation of Sri Lanka

- State Mortgage & Investment Bank

- Institutions owned by the Secretary to the Treasury under the Revival of Underperforming Enterprises or Underutilized Assets Act

- State Resources Management Corporation

- Department of Samurdhi Development

- Regional Development Bank

- National Enterprise Development Authority

- Small and Medium Enterprise Capital Company

- Small and Medium Enterprise Authority

- Grama Shakthi Bureau

- National Institute of Social Development

- Rural Development Training and Research Institute

- Social Security Board

- National Council For Persons with Disabilities

- National Secretariat For Persons with Disabilities

The post List of institutions brought under the purview of Finance Ministry appeared first on Adaderana Biz English | Sri Lanka Business News.

DFCC Group records a PAT of Rs.1.8bn for 1H 2020

- Advances grew by LKR 19Bn to 292 Bn (7% growth)

- Deposits grew by LKR 30 Bn to 278 Bn (12% growth)

- DFCC Group recorded a PAT of LKR 1.8Bn for the first half of the year 2020 Impairment charge of 1.5Bn for the first half of the year 2020

- Tier I Capital ratio of the Bank is 11.14% as at 30 June 2020

The post DFCC Group records a PAT of Rs.1.8bn for 1H 2020 appeared first on Adaderana Biz English | Sri Lanka Business News.

Local Manufacturers Welcome New State Ministry for Pharmaceutical Manufacture

The post Local Manufacturers Welcome New State Ministry for Pharmaceutical Manufacture appeared first on Adaderana Biz English | Sri Lanka Business News.

‘Seylan Fridays’ offer exciting discounts at Daraz.lk

The post ‘Seylan Fridays’ offer exciting discounts at Daraz.lk appeared first on Adaderana Biz English | Sri Lanka Business News.

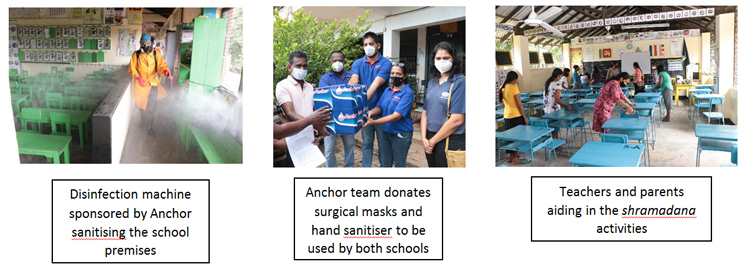

Anchor team strives to provide safe re-start for schoolchildren of Biyagama

The post Anchor team strives to provide safe re-start for schoolchildren of Biyagama appeared first on Adaderana Biz English | Sri Lanka Business News.

ComBank’s Flash enables contactless payments for Tenaga Car Park services

The post ComBank’s Flash enables contactless payments for Tenaga Car Park services appeared first on Adaderana Biz English | Sri Lanka Business News.

SIEMENS – DIMO Consortium continues to enhance National Power Supply with CEB

SIEMENS – DIMO consortium recently signed agreement with the Ceylon Electricity Board (CEB) to embark on the Medium Voltage distribution sub project package 05 of the “National Transmission and Distribution Network Development and Efficiency Improvement Project” aimed at enhancing national power supply. The package 04 of the above project was also awarded to the SIEMENS-DIMO consortium during the 1st quarter of 2020. The demand for electricity in Sri Lanka is growing at a rate of about 5-6% per annum. Therefore, the generating sources as well as the transmission and distribution facilities have to be developed and strengthened in order to meet this growth in demand. Medium Voltage Distribution System is the backbone of the power distribution network and is the interface between the Transmission network and the LV Distribution network which provide supply to the consumers. It is therefore essential to reinforce and develop a healthy Distribution System which has the capability of catering to the growing electricity demand of the country while maintaining an acceptable reliability and quality above the set operational standards and norms. Director of DIMO Wijith Pushpawela stated, “DIMO is pleased to facilitate the National Transmission and Distribution Network Development and Efficiency Improvement Project with the package 04 and 05. This is an important project in the nation‘s infrastructure development agenda as it will immensely contribute towards a more efficient and reliable power supply within Sri Lanka.” The scope of package 05 focuses on augmentation of the Ethulkotte Primary Substation with the aim of increasing capacity to cater the increase in electricity demand, provisioning of highly-reliable power supply with a high degree of operational flexibility in Battaramulla, Welikada and Kalubowila areas and to automate the distribution network. Construction of the New Primary Substation at Rattanapitiya with the aim of accommodating the anticipated load growth including town development requirements of Nugegoda, Boralesgamuwa and Maharagama areas which is fed by LECO and the requirements of the proposed educational area of the University of Sri Jayewardenepura are also included in this project. Augmentation of Beligaha Primary Substation with the aim of increasing supply demand in Galle, Dadalla and Karapitiya areas and to provide high degree of reliability and operational flexibility of the MV network in the Southern Province is another objective of this project. The agreement was signed between CEB and SIEMENS-DIMO consortium at the CEB Head Office premises with the participation of Vijitha Herath – Chairman of CEB, Y.G.I. Saman Kumara – Vice Chairman of CEB, Eng. Rohan Seneviratne – Additional General Manager of Distribution Division 4 of CEB, Sarath Algama – Director of DIMO, Wijith Pushpawela – Director of DIMO and Prasad Palsokar – SIEMENS Country Manager for Sri Lanka. Ms. N.U. Perera – Deputy General Manager (Planning & Development) Distribution Division 4, P.P.B. Samarasekara – Project Manager (GPDEEIIP-Tr2- Package 05) of CEB and Dasun Arandarage – Head of Power Engineering Projects of DIMO were also present at this occasion. DIMO and SIEMENS have been partners for over seven decades adding value to Power Generation, Transmission and Distribution Projects in the country with the latest technologies and the best solutions. The recent developments in the company’s product portfolio such as renewable energy, micro grid & smart grid solutions, will pave the way towards a sustainable energy mix which in return will be beneficial for the Government to achieve its objectives towards green energy. Photo Caption – Officials from CEB and SIEMENS – DIMO consortium at the agreement signing

The post SIEMENS – DIMO Consortium continues to enhance National Power Supply with CEB appeared first on Adaderana Biz English | Sri Lanka Business News.

CCC felicitates Prime Minister, new Cabinet and State Ministers

Colombo Chamber of Commerce felicitates Prime Minister Mahinda Rajapakse and the new Cabinet and State Ministers appointed with the clear mandate given by people of Sri Lanka at the general election. The mandate further conveys the confidence placed on President Gotabaya Rajapakshe to deliver the aspirations of the Nation which was conveyed beyond any doubt in the manner in which he faced the Challenge of Covid 19 and his other articulate directions and decisions which made him stand out as a capable and dedicated leader. CCC is confident that the new Prime Minister and his Ministers will navigate the Country to revive and drive the economy to success and live up to the hopes of its people. Further CCC appreciates the gazette notification issued prior to appointment of Ministers clearly demarcating subjects, responsibilities and the institutions under their purview enabling new Ministers to start work immediately to implement election pledge of the of the President “Vistas of Prosperity and Splendour” a reality. CCC which empowers youth and strongly believes in developing and preparing the next generation further appreciates appointing a set of young ministers to hold responsibilities of developing the country giving credence to the motto of CCC. CCC appeals to the New Government to give priority to MSME sector development, Exports and promote Sri Lanka as the destination for Services for businesssss from hubs like Singapore and UAE as we have the modules of requisite skilled services and global standard infrastructure facilities. Attract FDI for optimum utilization of the FTA’s and GSP Plus benefits which can be exploited to the maximum. CCC strongly supports the view that Sri Lanka will dawn to a brighter horizon in next five years and make the Nation proud of the Government’s achievements. Image Caption : President Colombo Chamber of Commerce (CCC) Saranga Wijeyarathne

The post CCC felicitates Prime Minister, new Cabinet and State Ministers appeared first on Adaderana Biz English | Sri Lanka Business News.

First Capital records PAT of Rs.1.07bn in 19/20 amidst challenging market conditions

First Capital Holdings PLC (the Group) the only listed investment bank in Sri Lanka, recorded a Consolidated Profit after Tax of LKR 1.07Bn for the year 2019/20, amidst negative headwinds that saw Sri Lanka, reporting subpar economic growth for the third consecutive year. The results show a significant growth compared to LKR 8Mn in the previous year. First Capital, with an impressive history of over 35 years, has total assets of LKR 45.6Bn and Equity in excess of LKR 4Bn. The Group recorded a Total Comprehensive Income of LKR 1.04Bn for the year, a significant increase from Comprehensive Loss of LKR 20Mn recorded in 2018/19. “Our ability to deliver impressive results even in tough times, is a testament to the Group’s robust operating model. I am convinced that the ongoing emphasis placed on strengthening each of our core businesses and firming up their positions within their immediate operating domain, has been a critical success factor for the Group”, commented Chairman, First Capital Holdings PLC, Nishan Fernando. The Group’s Primary Dealer contributed LKR 1.2Bn (2018/19 – LKR 96Mn) Profit after Tax for the year, claiming a substantial volume-based market share in both the primary auctions as well as in the secondary market during the financial year. Capitalising on the potential in the listed and unlisted debt market, the Corporate Finance division mobilised LKR 42Bn for its clients through structuring and placement of corporate debt securities, generating a fee income of LKR 175Mn (2018/19 – LKR 69Mn). The Wealth Management division of the Group, made remarkable progress to deliver its best financial results to date, reporting a fee income of LKR 64Mn (2018/19 – LKR 33Mn). The division showed a significant growth in its assets under management to end with LKR 26.4Bn as at 31st March 2020 (31st March 2019 – LKR 5.9Bn). Furthermore, the Company’s benchmark unit trust, the First Capital Money Market Fund was the best-performing unit trust fund in the country in 2019/20. The Group’s Stock Brokering unit also recorded revenue of LKR 71Mn for the year 2019/20 (2018/19 – LKR 53Mn). “While the last 12 months have been challenging for many local businesses, several aspects of our immediate operating environment worked in our favour; we are looking ahead and focusing our efforts on improving efficiency across all businesses to deliver enhanced results to our valued stakeholders’, commented Director/Chief Executive Officer, First Capital Holdings PLC, Dilshan Wirasekara. The Group’s [SL]A- credit rating was reaffirmed by ICRA Lanka Limited, reconfirming the stability of the Group. First Capital Holdings PLC paid a total dividend of LKR 9 per share for 2019/20 totaling to LKR 911Mn. Image – Nishan Fernando – Chairman, First Capital Holdings PLC and Dilshan Wirasekara – Director/Chief Executive Officer, First Capital Holdings PLC

The post First Capital records PAT of Rs.1.07bn in 19/20 amidst challenging market conditions appeared first on Adaderana Biz English | Sri Lanka Business News.

CAL advises Sunshine Holdings on Rs.1.7bn acquisition of Daintee Limited

Consolidating its stance as a Sri Lankan family business expert, Capital Alliance Partners Limited (CAL) advised Sunshine Holdings PLC on the acquisition of Daintee Limited. The transaction was structured by CAL to enable the Sunshine Group to expand its operations in the FMCG space with the use of Daintee’s well established brands, thereby maximizing the growth prospects of both entities. Functioning as the Buy-side Advisors to the Sunshine Group, CAL was entrusted the role of harnessing the value of the Daintee brand that has been created over the years and plugging it into the Sunshine Group such that they can expand their presence as a leading FMCG conglomerate in Sri Lanka. Having negotiated through a number of prospective investors, CAL played an instrumental role in the implementation of the transaction by liaising with all related parties and engaging in negotiations with Daintee, on behalf of Sunshine, securing the most beneficial terms of the transaction. Having been a family run business over the past 35 years, Daintee has become a household name as one of the largest players in the confectionary space in Sri Lanka with an island-wide footprint and over 95,000 touchpoints. Sunshine Holdings is one of Sri Lanka’s most respected conglomerates, with a core focus in Healthcare, Agribusiness, Consumer Goods & Renewable Energy. The group has a 50 year heritage that started as a prestigious family owned business, growing to become one of the most respected conglomerates Listed on the Colombo Stock Exchange bearing a name synonymous with quality. Commenting on the acquisition, the Group Managing Director Vish Govindasamy said; “I believe this transaction positions the Sunshine Group on the path to becoming the leading FMCG conglomerate in Sri Lanka and is a strong statement about our vision to grow.” CAL’s VP of investment banking Rizny Faisal went on to say “The transaction is a boost for the country’s capital markets in a post COVID landscape and has been a testament to CAL’s unwavering commitment to its’ clients, whilst solidifying CAL’s stance as Sri Lanka’s family business expert in investment banking.”

The post CAL advises Sunshine Holdings on Rs.1.7bn acquisition of Daintee Limited appeared first on Adaderana Biz English | Sri Lanka Business News.

Sampath Bank, backed by a One Trillion Rupee Balance Sheet, works hand in hand with all stakeholders to create a better future for the Nation

The global economy took a steep downward trend with the outbreak of COVID – 19 pandemic epicentre shifting from China and East Asia to the United States and Europe. Most countries declared prolonged lockdowns and movement restrictions with a view to controlling the disease, which severely hampered worldwide economic activity and global trade from March 2020. Domestically, the COVID – 19 outbreak weakened the Country outlook substantially as it brought further stress to an already challenged macroeconomic situation. Responding to these economic challenges, the Central Bank of Sri Lanka took steps to cut policy rates twice during the second quarter, resulting in the Standard Deposit Facility Rates and the Standard Lending Facility Rates dropping to 5.5% and 6.5%, respectively by 30th June 2020. At the same time, the Statutory Reserve Requirement (SRR) was reduced in two stages from 5% to 2% during the 1H 2020, in a bid to improve liquidity levels in the market. While the economy and the banking sector as a whole continued to face unprecedented challenges due to the COVID-19 pandemic, Sampath Bank is pleased to announce that its total assets crossed the Rs One Trillion (1 Tn) mark for the first time in its history. Reaching this milestone in the span of just 33 years, probably makes Sampath Bank the youngest business organisation in Sri Lanka to achieve this significant milestone During this difficult period the Bank redoubled efforts to serve its valued customers, who were severely impacted by the prolonged lockdown, to overcome the challenges and hardships faced by them. By leveraging its IT supremacy and substantial investments made in technology platforms and the widespread branch network, Sampath Bank was able to operate seamlessly during this time of disruption. The Bank was quick to implement all the relief measures introduced by the government, with approximately 50% of the Bank’s loan portfolio being granted relief under the government announced moratorium scheme. Further, the Bank actively engaged in providing working capital loans under “Saubhagya” scheme introduced by the government and took proactive steps to provide necessary assistance to customers across all segments who required special attention, including re-scheduling of loan repayments of those customers who were severely impacted. Given the unprecedented challenges witnessed in the first half of 2020, it is important to note that comparing the Financial result of the first half of 2020 with 2019 may not be realistic. Financial Result of Sampath Bank for the First Half of 2020 Sampath Bank registered a profit before tax (PBT) of Rs 5.32 Bn and a profit after tax (PAT) of Rs 3.97 Bn for the six months ended 30th June 2020. Despite the unique challenges that prevailed since midMarch 2020, the Bank was able to limit the decline in PBT and PAT to 8% and 3.2% respectively compared to the corresponding period in 2019. The Bank made solid progress towards its targets set for 2020, which together with diversified product portfolio embedded with technological advancements and strong cost control measures helped the Bank to control the impact on profits. PBT and PAT of the Group also declined by 7.7% and 4.2% respectively for the six months ended 30th June 2020 and stood at Rs 5.48 Bn and Rs 3.99 Bn respectively. Meanwhile, the Bank remained well-capitalized with a Tier 1 capital ratio of 13.30% and a Total capital ratio of 16.77% Fund Based Income (FBI) The Bank’s Net Interest Income (NII) for the quarter ended 30th June 2020 was significantly affected by two factors – reduction in policy rates in order to provide relief to the economy and the moratorium granted to customers. Consequently, the day one loss on account of COVID – 19 moratorium was recorded against the interest income as per the modification method given in the Sri Lanka Accounting Standard – 9 (SLFRS – 9). As the entire day one loss that arose due to COVID – 19 moratorium has been recorded during the period under review, Sampath Bank does not have to incur any additional impact on interest income during the 2H of 2020. Due to the reasons mentioned above, the Bank’s Net Interest Income declined by 11.9% and stood at Rs 17.4 Bn for the 1st half of 2020 compared to the same period in 2019. While closely monitoring the factors affecting this reporting line, the Bank’s ALCO continued to take necessary action to manage the net interest income to the best possible level. Overall, interest income for the period decreased by Rs 5.0 Bn to Rs 46.2 Bn compared to Rs 51.2 Bn recorded in the corresponding period in 2019, denoting a decline of 9.8%. The total interest expenses stood at Rs 28.8 Bn in 1H 2020 compared to Rs 31.4 Bn recorded in the corresponding period of 2019, a reduction of 8.5%. Consequently, the Net Interest Margin for the 1H 2020 decreased to 3.57% compared to 4.46% reported in 2019. Non-Fund Based Income (NFBI) Net fee and commission income, which comprise of credit, trade, card, and electronic channel related fees, was limited to Rs 3.8 Bn during the period under review, a decline of 18.9% over the figure reported in 1H 2019. The decline was mainly due to the decrease in credit-related fee and commission income consequent to the restrictions imposed to assist customers during this difficult period. Meanwhile, the fee and commission income from electronic channels showed strong growth owing to the high usage of Sampath Vishwa and other popular electronic products. Other operating income (net) recorded a significant YoY increase of 509% in the 1st half of 2020, led mainly by an increase in realized exchange income due to the 2.7% depreciation of the Sri Lankan Rupee against the US Dollar. Consequently, other operating income (net) for the first six months of 2020 increased to Rs 2.6 Bn, from the loss of Rs 642 Mn reported for the corresponding period in 2019. On the other hand, the Bank incurred a net trading loss of Rs 107 Mn as a result of mark to the market losses on forward exchange contracts owing to the aforementioned currency depreciation. Therefore, the Bank’s net exchange income from foreign exchange transactions amounted to Rs 1.8 Bn for the period under review. Operating Expenses Operating expenses, which stood at Rs 10.1 Bn during 1H 2019, decreased to Rs 9.6 Bn during the period under review, reflecting a YoY decline of 5.2%. The cost optimization strategies implemented by the Bank to face the situation was instrumental for this achievement. Meanwhile, the Bank’s Cost-to-Income ratio (excluding taxes on financial services) increased marginally to 40.2% in the first six months of 2020, from 38.8% reported for the corresponding period in 2019. The main reason for this marginal increase was the drop in the key income sources during the first half of 2020. Impairment Charges on Loans and Receivables The Bank has provided a substantial credit loss provision for customers whose credit risk has significantly increased due to the prevailing economic recession. As a result, the impairment charge against individually significant customers increased to Rs 4.3 Bn in 1H 2020 from Rs 2.5 Bn in the corresponding period in 2019. After analyzing the economic downturn, Sampath Bank management decided to increase the credit loss provision at the portfolio level as well. However, the collective impairment charge for the first six months of 2020 is lower compared to the first half of the last year due to the explanation given below. The credit quality of the loan portfolio was severely affected in April 2019 due to the terrorist attack that took place in April 2019 which prompted the Bank to increase its collective impairment provision in Q2 2019. Business Growth Sampath Bank’s total asset base grew by 4.5% (annualized 9.0%) during the period under review to reach Rs 1 Tn as at 30th June 2020. It stood at Rs 962 Bn as at 31st December 2019. Gross loans & advances grew by 3.9% (annualized 7.8%) to reach Rs 748 Bn as at 30th June 2020, recording a growth of Rs 28 Bn for the period under review. The total deposit base increased by Rs 72 Bn for the same period, to reach Rs 790 Bn as at the reporting date, a growth of 10% (annualized 20%). Meanwhile, the CASA ratio, which stood at 36.6% as at 30th June 2020 improved marginally from the 31st December 2019 position of 35.2%. Performance Ratios Return on Average Equity (ROE) (after tax) declined from 11.78% as at 31st December 2019 to 7.56% as at 30th June 2020, in direct correlation to the lower PAT. Return on Average Assets (ROA) (before tax) also declined to 1.09% from 1.66% as at 31st December 2019. The Statutory Liquid Asset Ratio (SLAR) for the Domestic Banking Unit and the Off-Shore Banking Unit stood well above the mandatory requirement of 20% throughout the period and ended up at 28.12% and 33.88% respectively as at 30th June 2020. Capital Adequacy The Bank’s Common Equity Tier I Capital, Tier I Capital and Total Capital Adequacy ratios as at 30th June 2020 stood at 13.30%, 13.30% and 16.77% respectively, all well above the minimum regulatory requirement of 6.5%, 8% and 12.0%, applicable as at the reporting date.

The post Sampath Bank, backed by a One Trillion Rupee Balance Sheet, works hand in hand with all stakeholders to create a better future for the Nation appeared first on Adaderana Biz English | Sri Lanka Business News.

Amãna Bank unveils Digital Self Banking Zone

Amana Bank recently commissioned a digitally enhanced Self Banking Zone at the Bank’s Dehiwala branch, with the aim of providing a convenient self-banking experience to its customers. The Self Banking Zone facilitates customers to seamlessly engage in day to day banking transactions such as Cash Withdrawals, Cash Deposits and Bill Payments while also facilitating many other transactions digitally through the newly established Self Service Kiosk. The Self Service Kiosk will enable customers to register for Internet Banking, E-statements and SMS alerts; apply for a Debit Card while also allowing customers to manage their Debit Card functionalities such as requesting to link new accounts to the card, PIN change and limit enhancement. Commenting on the launch, the Bank’s Chief Information Officer Rajitha Dissanayake said, “The introduction of the Digital Self Banking Zone is part of our approach to enhance the customer’s banking experience with greater convenience and accessibility in line with our people friendly banking model. We hope to further expand this service in the near future.” Sharing his thoughts the Bank’s Head of Digital Banking Sanjeewa Fonseka said “We believe that the digitally enhanced Self Banking Zone will support our customers to carry out most of the over-the-counter services at a time of their comfort without requiring to visit the branch during banking hours.” Amãna Bank is the country’s first and only Licensed Commercial Bank to operate in complete harmony with the globally growing non-interest based people friendly banking model. With the mission of Enabling Growth and Enriching Lives, the Bank reaches out to its customers through a growing network of branches and Self Banking Centres spread across the country while having access to 4500 +ATMs for withdrawals and 700+ Pay&Go Kiosks for real time deposits . Customer can also benefit from an array of customer conveniences such as Internet & Mobile Banking, 24×7 Cash Deposit Machines and Banking Units Exclusively for Ladies. Amana Bank PLC is a stand-alone institution licensed by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange with Jeddah based IsDB Group being the principal shareholder having a 29.97% shareholding of the Bank. The IsDB Group is a ‘AAA’ rated (S&P, Moody’s & Fitch) multilateral development financial institution with a membership of 57 countries. In June 2020 Fitch Ratings Sri Lanka declared an upward revision of the National Long Term Rating of Amãna Bank to BB+(lka) with a Stable Outlook. Amãna Bank does not have any subsidiaries, associates or affiliated institutions, other than its unique flagship CSR venture, the ‘OrphanCare’ Trust.

The post Amãna Bank unveils Digital Self Banking Zone appeared first on Adaderana Biz English | Sri Lanka Business News.